Business Outline

We were established to structure high quality and beneficial investment products, for the real asset leasing market based on the SBI Group’s “Customer-Centric Principal”. At SBI Leasing Services, we purchase aircraft and ships which require substantial funds and lease them to airlines and shipping companies, thereby affording them more financial flexibility. We also offer operating lease products to investors looking for the dividends obtainable from a lease, such as income.

JOL (Japanese Operating Lease)

Real asset investment in aircraft.

Investors earn cash dividend from the lease income during the lease term and capital gains when selling the target property on the resale market at the end of the lease. Aircraft can be held by one or more companies, and leased to airlines through (SPC) unions under the Japanese Civil Code.

For investors, lease rental revenue and aircraft capital depreciation can be recognized.

Examples of our track record

JOLCO(Japanese Operating Lease with Call Option)

Japanese Operating Lease with Call Option, is a lease format which offers the lessee the right to purchase the leased item (call option) either during the lease term or at lease end.

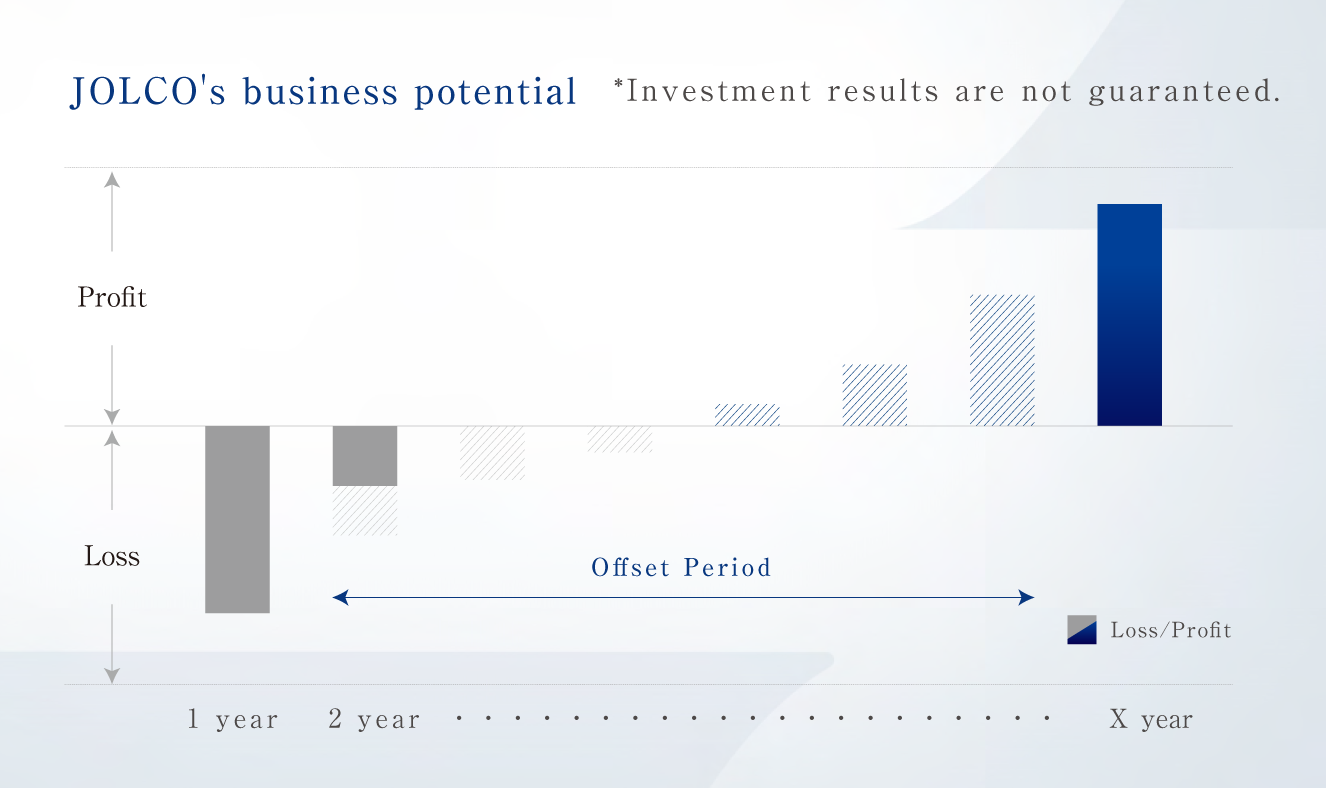

Investors can enjoy tax advantages such as profit equalization using medium to long-term strategies through a series of lease transactions.

Examples of our track record

General Aviation

We acquire depreciable assets such as small aircraft and helicopters and structured investments of leased assets, then sell them to investors. Investors gain income from lease payments during the lease term, and capital gains from the sale of the leased property at the end of the lease.

The main products handled are small aircraft and air ambulances (called “Doctor Heli” in Japan). Air ambulances are of particular interest to investors since they include ESG and CSR components.

We aim to provide optimal investment products and services by expanding our lineup to suit the diverse needs of our investors.

Examples of our leased assets

Principal Investments

Here, SBI Leasing Services acts directly as a ship charterer. By enhancing the shipping finance menu we provide, and working to ensure stable revenues through ship usage revenue, we can increase our presence in the ship financing market. Therefore, we strengthen our ability to collect information such as investment and procurement needs, thus allowing us to provide ongoing shipping projects to investors.

In addition, we mainly handle ships which include technology that supports EEDI (Energy Efficiency Design Index) for new vessels. This will contribute to ESG investment opportunities that should enable meaningful responses to global environmental issues. We structure projects that also take environmental measures into account, such as reducing CO2 emissions.

Examples of our assets include

25,000 DWT stainless steel chemical tanker

25,000 DWT stainless steel chemical tanker