We structure and provide Japanese Operating Lease products which invest in real assets such as aircraft and ships.

Investment in commercial aircraft.

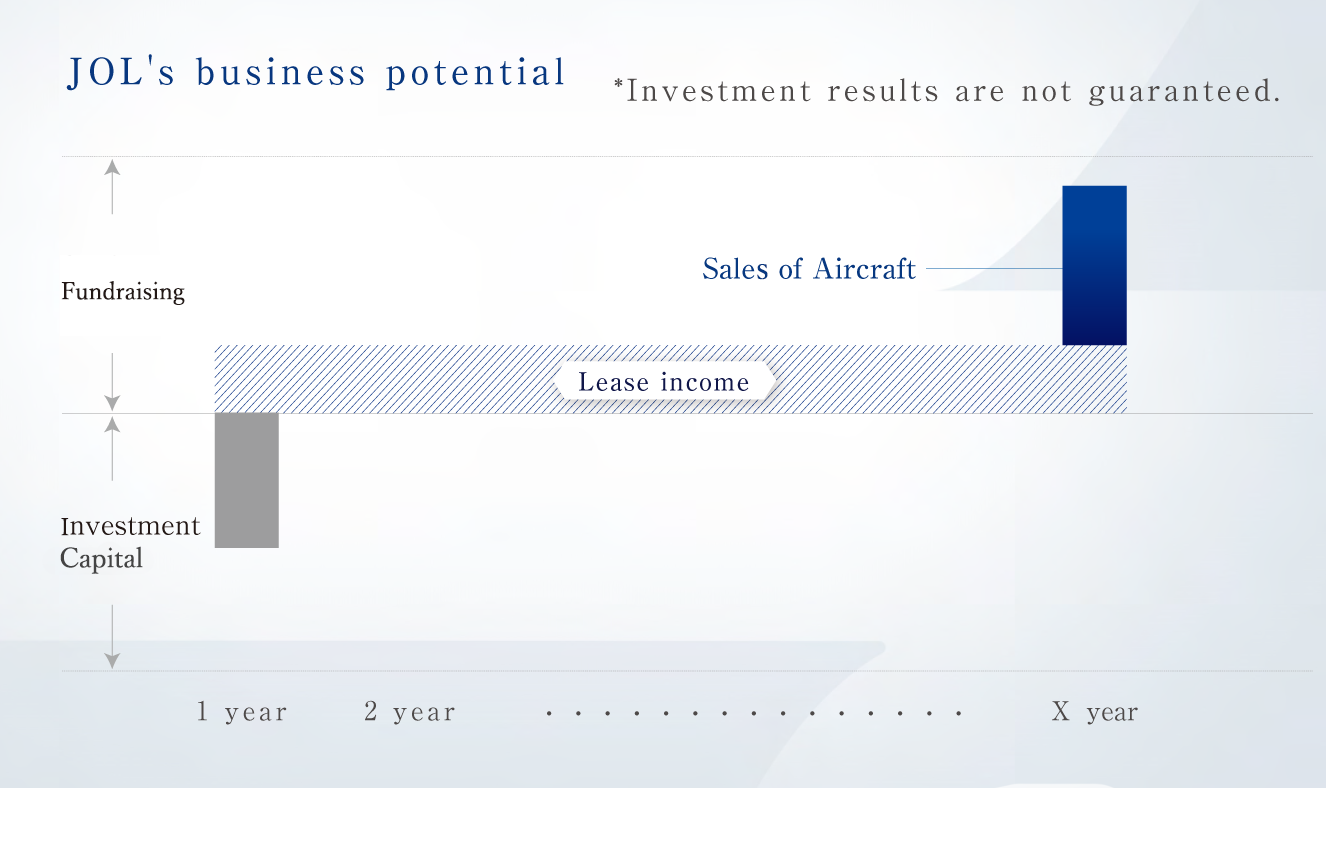

During the lease term, we distribute dividend from the lease income, and obtain capital gains when selling the the target property at lease end.

Aircraft can be held by one or more companies, and leased to airlines through (SPC) unions under the Japanese Civil Code.

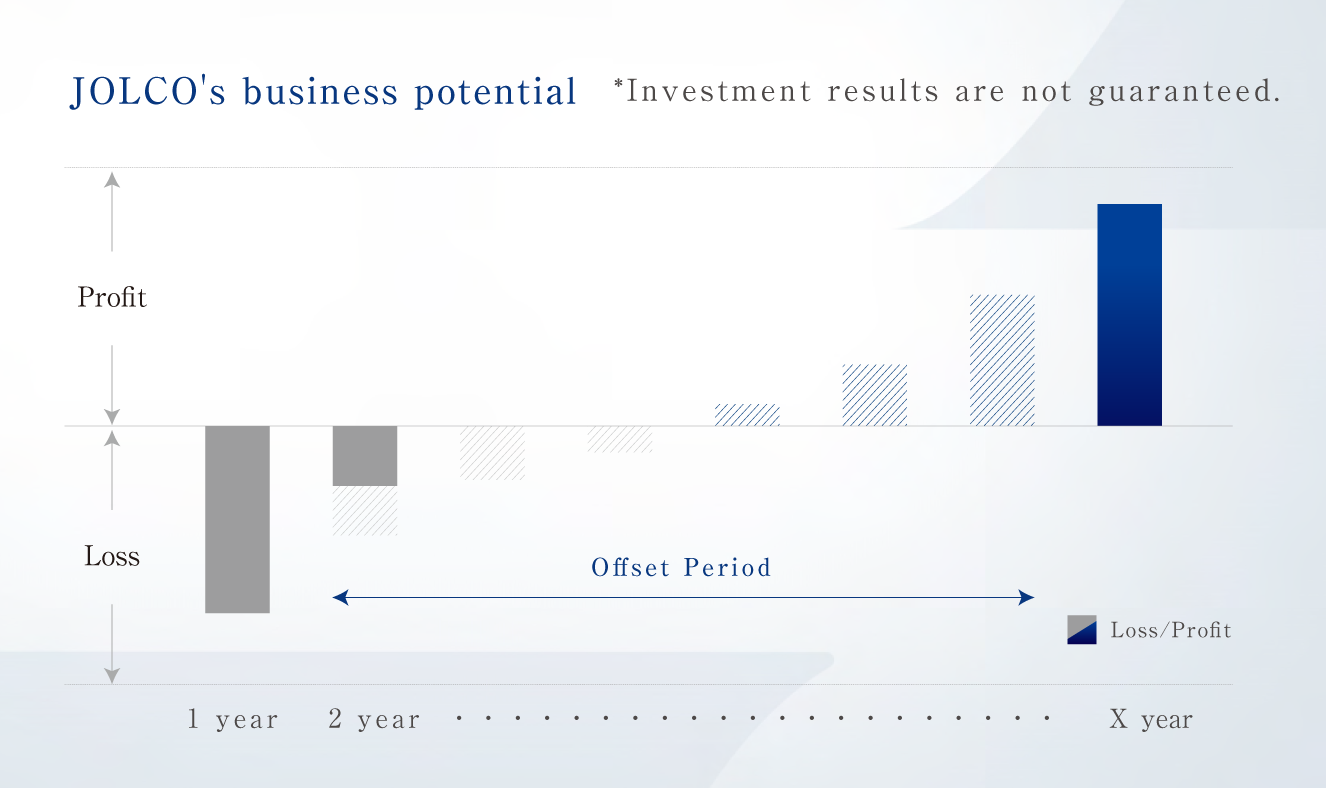

Investors earn lease rental income, recorded as revenue, and depreciation of capitalized aircraft is included.

Japanese Operating Lease with Call Option, is a lease format which offers the lessee the right to purchase the leased item (call option) either during the lease term or at lease end.

Investors can enjoy tax advantages such as profit equalization using medium to long term strategies through a series of lease transactions.